Need a little help with personal finances? Here are some resources

Processing Request

Processing Request

By Emilyn Linden

The last couple of years I’ve been working hard to get my finances in order. I’ve never been terrible with money, but I’ve never been great with it either. I decided that while I’ll never be as knowledgeable as a certified financial planner or an accountant, I wanted to be able to (mostly) handle my finances by myself. And I’m an older millennial who would like to retire someday, so I thought I’d better get working on my finances sooner than later.

Personal finance in America is a fraught issue. Most people don’t have as much money saved for retirement as they should. Many people have lots of student loan debt. And many people don’t have an adequate emergency fund. COVID-19 has highlighted the precarious financial situation of many people. It also seems like many people are more interested in getting their finances figured out because of the pandemic.

If you’re interested in educating yourself about personal finance, it can seem overwhelming. Lots of people don’t do it because they just don’t know where to start. I put it off for quite awhile myself, but I’ve found some books/podcasts that are good for a beginner.

No matter how you choose to educate yourself on personal finance, I recommend following a blog, joining a Facebook group, or subscribing to a YouTube channel just to keep learning and thinking about it. Many of us have lots of ingrained, bad financial habits and it takes time to break those. Making sure you continue to think about your financial decisions helps you replace bad habits with good ones.

Podcasts

How to Money Matt and Joel create a few podcasts a week and they’re up to over 200 at this point, so I recommend picking and choosing which episodes you want to listen to that are relevant to your finances. They cover everything from online banking to rebuilding your credit score.

Afford Anything by Paula Pant “You can afford anything, but not everything.” Paula creates some great content. Her focus is on increasing income through side hustles and real estate.

ChooseFI This one is for if you’re well on your way down the personal finance rabbithole. ChooseFI focuses on FIRE (financial independence, retire early). The goal is to cut your living expenses (and save those cuts) so far that you can retire in as few as 10 years. I’m not that disciplined, but they share a lot of great financial tips and motivational stories from people who have been able to retire ridiculously early.

Books

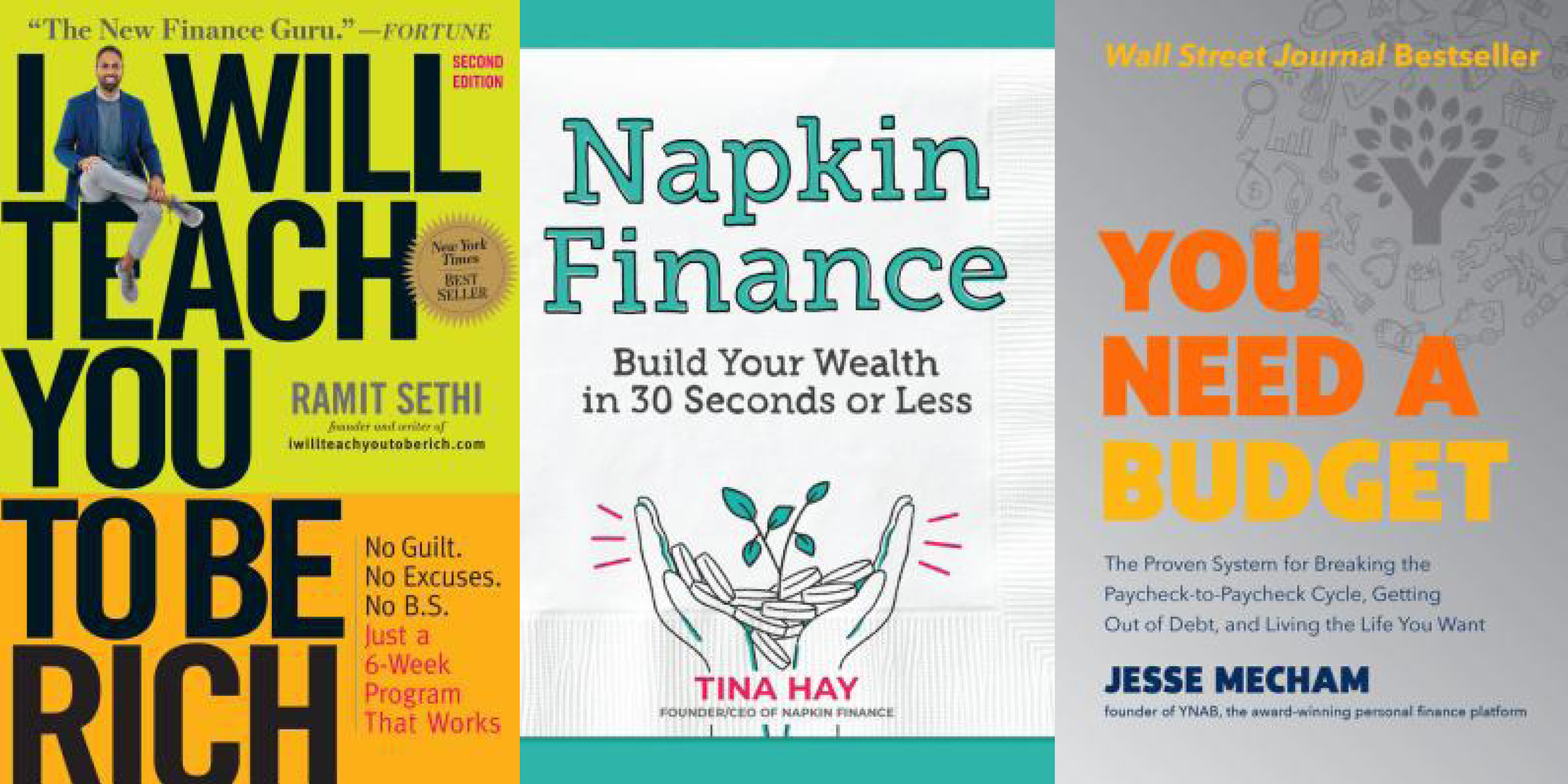

I Will Teach You to Be Rich Ramit Sethi is a prolific personal finance content creator. I skim his blog fairly regularly, but he’s also on YouTube, Facebook, Instagram, etc. His book is a good starting point to bring all of his most important tips together.

Napkin Finance Tina Hay has written a quick and streamlined guide to personal finance. This is a good one to introduce you to personal finance concepts and just dip your toes in.

You Need a Budget This title by Jesse Mecham covers the basics of creating a budget. There’s a (paid) app by the same name that covers the same basic steps and helps you track your budget, but you don’t need to use the app to follow the program.

The Index Card Helaine Olen and Harold Pollack teamed up to write this guide to personal finance. Personal finance can be complicated, but the average person probably doesn’t have a complicated financial situation. The most basic and important money management information can fit on a 4 x 6 index card.

YouTube

I honestly don’t watch a lot of personal finance YouTube content just because I prefer to listen to podcasts and read blogs and books. There are some great personal finance YouTube channels out there for those who prefer videos, though. One that I do watch every once in a while is Minority Mindset by Jaspreet Singh. His videos are usually 10 minutes or less. The Dave Ramsey Show also has A TON of content since he’s been making videos for so long. Ramsey is probably one of the most well-known names in personal finance. I don’t agree with much of his advice on investing, but if you have a lot of debt, his content is a great place to start.

Emilyn Linden is a librarian in the Information Services department.